FinTech

October 10, 2022

●

More like this

Learn more

FinTech

November 6, 2025

Barion Wins “Fintech of the Year 2025” at the Visa Awards

FinTech

November 30, 2022

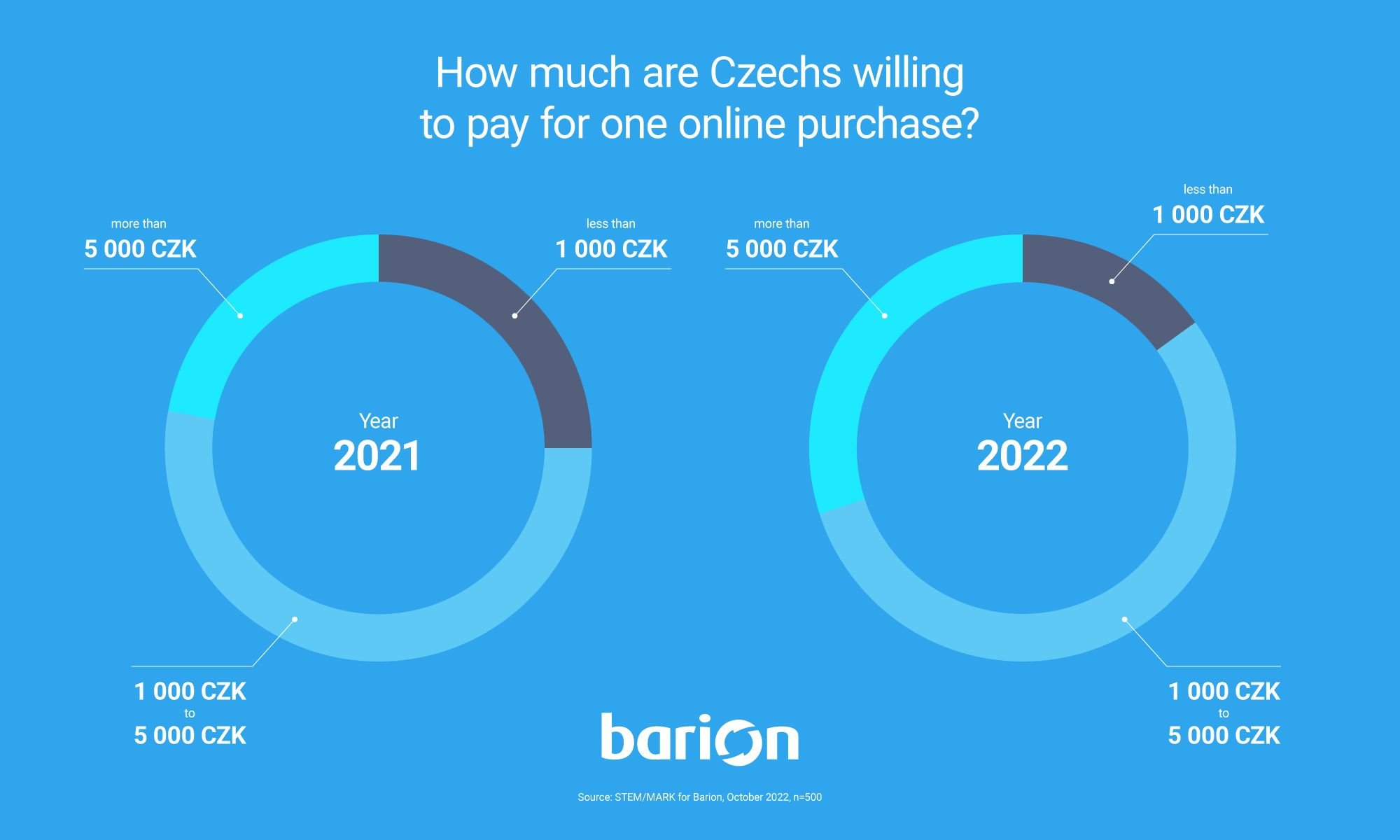

The latest online payment trends in the Czech Republic

Catch up with the latest trends and tendencies of the e-commerce sector and digital payments in the Czech Republic.

FinTech

October 28, 2022

How do payment gateway providers hide their fees?

Transaction fees, monthly subscriptions, no flat rates - payment providers have many options to hide their fees. We listed them all to help you make the best offer on the market.

Facebook

Facebook Discord dev community

Discord dev community @BarionPayment

@BarionPayment

EU Licensed & Regulated Financial Institution

EU Licensed & Regulated Financial Institution